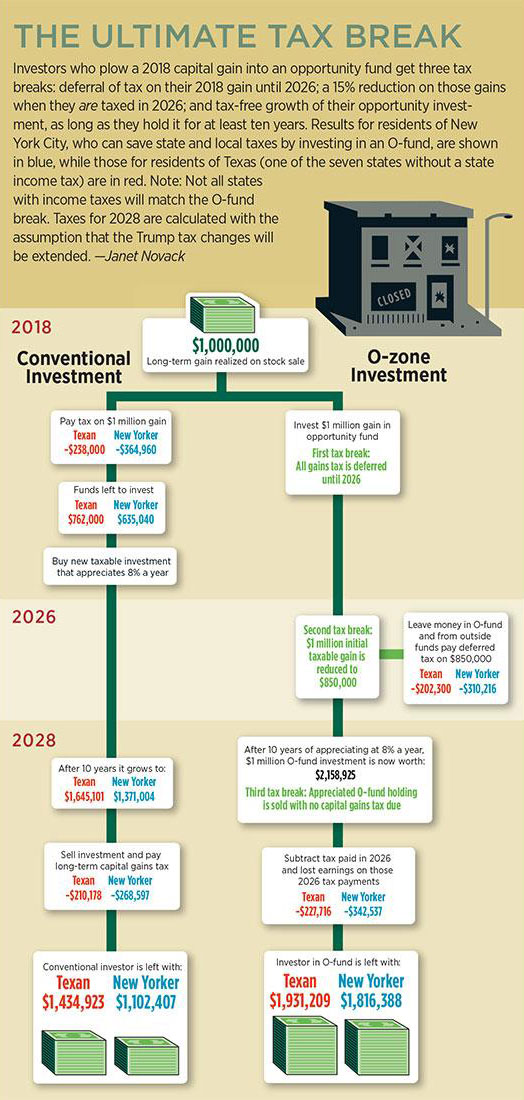

The recently passed Tax Reform Act included a potential tax break for investors. An investor may defer capital gains taxes on the sale of any asset. These taxes can potentially be deferred until December 31, 2026, or the date of a sale (whichever is earlier). As discussed below, this original capital gains tax is reduced over time, and if held long enough, new appreciation on the investment can be realized tax free.

Here’s how the process works. An investor sells an asset and generates a capital gain. The capital gains from that investment must be reinvested within 180 days into a designated Opportunity Zone (OZ). An OZ is a specially designated census tract. Large parts of the U.S. are eligible for designation, including many commercial, industrial and residential areas.

If the investment is held, the capital gains liability on the original investment will be reduced by 10% after five years and by 15% after seven years. After 10 years, the new capital gains taxes generated from the opportunity fund investment are reduced to zero.

With Somerset strategic knowledge and positioning in the South Bronx, we feel there is no better company to take advantage of this unique opportunity!

Invest in this fund, and potentially enjoy substantial tax breaks by utilizing your tax dollars.

It’s possible to generate stable cash flow and receive additional tax benefits through expensing and depreciation.